Hey there! Making smart financial choices in real estate can be quite a challenge. Especially when it comes to hard money loans, it’s crucial to crunch the numbers before taking the plunge into any property investment. So, let’s dive into the top five hard money loan calculators that’ll make navigating this complex financial landscape a breeze.

Real estate investments funded through hard money loans demand careful financial planning. The key to estimating costs, evaluating potential returns, and minimizing risks lies in accurate calculations. By understanding these figures, you’ll be well-equipped to make informed and strategic investment decisions.

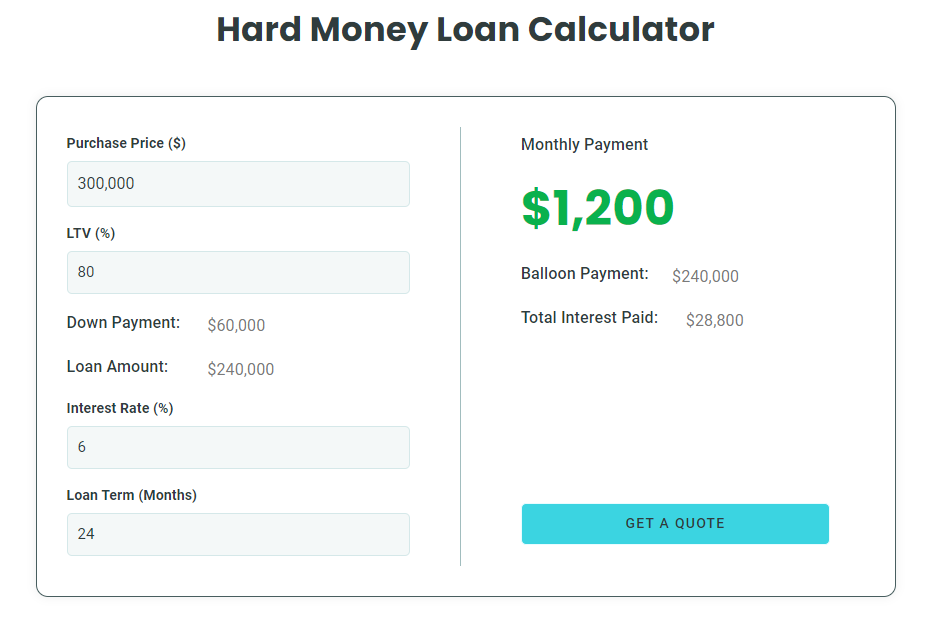

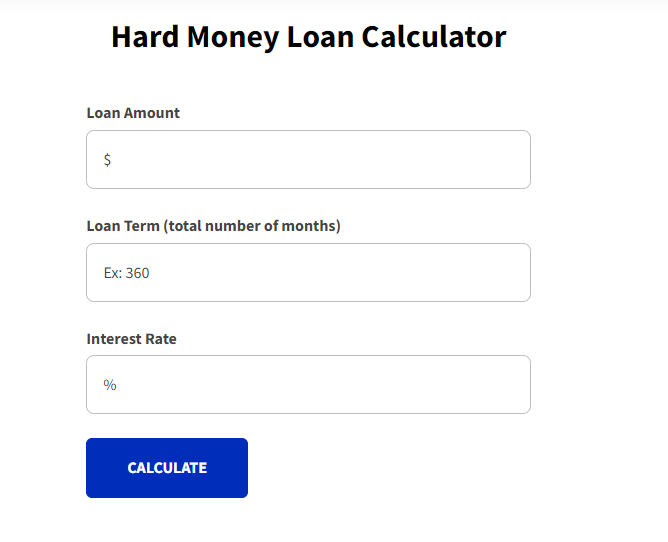

Hard Money Loan Calculator – Loanbase

When it comes to calculating fees and interest rates, Loanbase’s hard money loan calculator takes the complexity out of the equation. This nifty tool is a lifesaver, allowing you to foresee costs before committing to a loan.

Whether you’re a beginner or a seasoned investor, this review breaks down the essential formulas and elements involved in hard money loan calculations. It even sheds light on higher rates, shorter repayment terms, and the all-important loan-to-value ratio. And don’t worry, it uses practical examples to illustrate fee structures and payment schedules, making the financial commitments crystal clear.

On top of that, it delves into negotiation tactics, and early repayment advantages, and even compares hard money loans with alternative financing options.

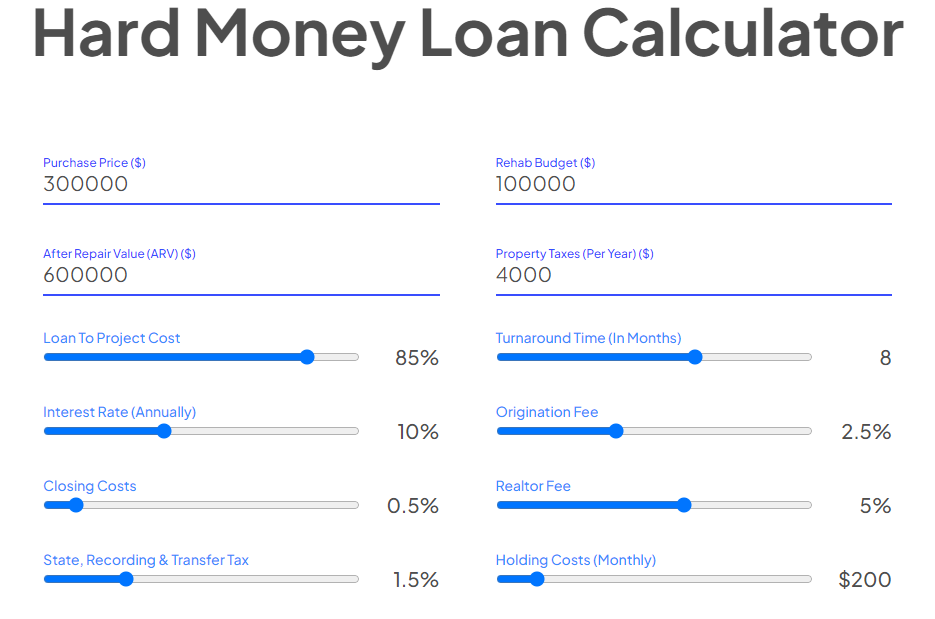

Hard Money Loan Calculator – Newsliver

Now, here’s a powerhouse tool for all you house flippers out there – Newsliver’s hard money loan calculator. Beyond basic calculations, this calculator provides you with in-depth insights into the world of hard money loans. By breaking down all the nitty-gritty details, it swiftly computes crucial financial metrics like net profit and return on investment (ROI).

But wait, there’s more! They’ve also included FAQs and additional calculators tailored to various real estate scenarios, empowering you with knowledge at every step. And guess what? They’ve integrated FlipScout, a fantastic property search engine for flippers, to enhance its practicality. It’s truly an essential companion, whether you’re a newbie or an experienced flipper.

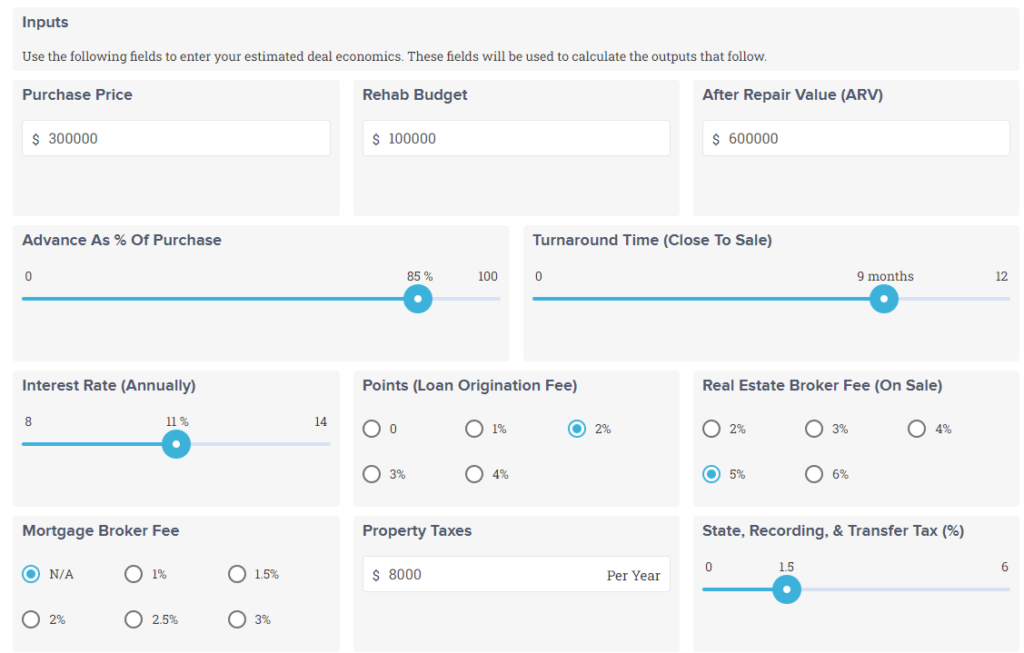

Abl1 Calculator

ABL’s fix-and-flip hard money loan calculator is all about simplicity. It takes care of the financial intricacies of real estate investors, offering a user-friendly interface to input estimated deal figures. With instant calculations of metrics like total project cost and net profit, it gives you the confidence to make sound investment decisions.

This calculator goes the extra mile with features like pre-qualification options and information about ABL’s lending states, adding depth to its practicality. And if that’s not enough, it educates users through FAQs, ensuring transparency about estimate limitations.

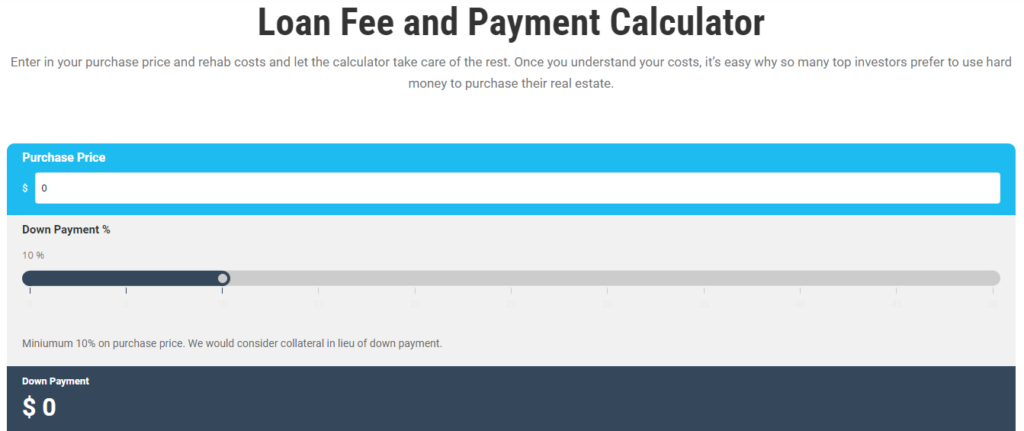

Loan Fee and Payment Calculator – Thehardmoneyco

Here’s where The HardMoney Company comes in with their streamlined and user-friendly hard money loan calculator. It’s a breeze to input the purchase price, repair costs, and down payments, as it swiftly calculates essential financial metrics.

They break it all down, providing a clear view of estimated cash-to-close and monthly payment components. This calculator emphasizes flexibility and speed in hard money loans, catering to investors seeking a hassle-free borrowing experience.

Hard Money Loan Calculator – Hardmoneycompany

The HardMoney Company’s calculator simplifies the complexities of hard money lending. Planning investment strategies and estimating monthly payments and interest rates has never been easier. But what sets it apart is the transparent breakdown of variables that impact loan costs.

Their customer-centric approach shines through as they educate users on loan requirements. When it comes to being a reliable hard money lender, they’ve got it covered. Trust and credibility are at the heart of their company profile.

These top five hard money loan calculators not only make loan estimations a piece of cake but also offer invaluable insights for making informed investment decisions in real estate. So, go ahead and explore these fantastic tools, and may your real estate ventures be profitable and successful!

Check more articles:

Commercial Real Estate Loans with No Down Payment

The Power of Conventional Rehab Loan

If you are looking for loan service then go to Emcap Loan Services