Welcome to the world of "Frankenstein" properties, those unique, multi-faceted buildings that make traditional bank underwriters break out in a cold sweat. If you’re considering stepping into the mixed-use arena, you already know that these deals aren’t your average "cookie-cutter" residential flips. They require a bit more grit, a lot more vision, and a lending partner who isn't afraid of a little complexity.

At Emerald Capital Funding, we thrive on the complex. We recently closed a deal that perfectly illustrates why mixed-use properties are the ultimate "dream" for investors looking to diversify their portfolios and maximize cash flow. We’re talking about a project in Buffalo that involved a six-unit building and a massive mixed-use property featuring eight storefronts, a restaurant, and even a single-family home.

This guide will equip you with the knowledge of how we handle these "Real Deal" highlights and how you can leverage our flexible lending solutions to scale your own real estate empire.

What Is a Mixed-Use Dream?

Before we dive into the nitty-gritty of the Buffalo deal, let’s define what we mean by mixed-use. In the lending world, a mixed-use property is any building that combines residential and commercial space. Think of a classic Main Street building: a retail shop or a restaurant on the ground floor with apartments upstairs.

However, the deal Sonny brought to the table was a bit more involved. This wasn't just a "mom and pop" shop with a studio overhead. This was a strategic acquisition in Buffalo that included:

- A dedicated six-unit residential building.

- A sprawling property featuring eight separate storefronts.

- An operational restaurant.

- A single-family home located on the same parcel.

When you have that many moving parts, most lenders start looking for the exit. They see "restaurant" and think "high risk." They see "storefronts" and worry about vacancy rates. But at Emerald Capital Funding, we see something else: multiple streams of income.

The Buffalo Breakdown: Why This Deal Worked

The beauty of the Buffalo project was the sheer diversity of the assets. If the restaurant has a slow month, the six apartments are still paying rent. If one storefront goes dark, the single-family home and the other seven shops keep the engine running.

This is what we call "built-in diversification." However, getting a loan for this requires a systematic, step-by-step approach. Here is how we looked at it:

1. The Power of the DSCR Loan

For a deal like this, we often look toward DSCR (Debt Service Coverage Ratio) loans. This is a game-changer for investors who are tired of jumping through bank hoops. Instead of looking at your personal tax returns or your W-2 from three years ago, we look at the property’s ability to pay for itself.

If the combined income from the restaurant, the storefronts, and the residential units covers the mortgage and expenses (with a little breathing room), you’re in business. We’ve got you covered with loans that focus on the asset’s performance rather than your personal debt-to-income ratio.

2. Navigating the Commercial-to-Residential Mix

Lenders usually have strict rules about the percentage of commercial space vs. residential space. For many specialized DSCR mixed-use loans, the "sweet spot" is a maximum of eight units with no more than three commercial units. But when you have eight storefronts and a restaurant, you’re moving into true commercial real estate territory.

Don't worry; this is where our versatility shines. We don't just have one "bucket" of money. Whether it’s a small mixed-use building or a massive shopping center with a house attached, we have the bridge loans and commercial products to bridge the gap.

3. Faster Closings with Asset-Based Lending

In a hot market like Buffalo, speed is everything. Traditional banks can take 60 to 90 days to close a complex mixed-use deal. By using asset-based lending, we can often cut that time in half. We focus on the property value and the revenue-generating potential, which allows us to bypass much of the red tape that slows down conventional financing.

Actionable Takeaway: If you find a property with a weird mix of units, don't walk away. Calculate the total potential income first. If the math works, the funding usually will too.

Why Traditional Banks Say "No" (And Why We Say "Yes")

I’ll be honest with you: traditional banks love boring deals. They love a three-bedroom, two-bath house in a suburb where every other house is exactly the same. When you bring them a "restaurant-storefront-house" combo, their software literally doesn't know what to do with it.

Here are the three big reasons banks reject these deals:

- Complexity of Valuation: How do you appraise a restaurant and a single-family home on the same lot? It’s hard work, and most bank appraisers don't want to do it.

- Risk Aversion: Restaurants have higher turnover than residential tenants. Banks see this as a red flag; we see it as an opportunity for higher-than-average returns.

- Strict Underwriting: Banks are tied to federal regulations that often limit how much commercial "weight" a residential loan can carry.

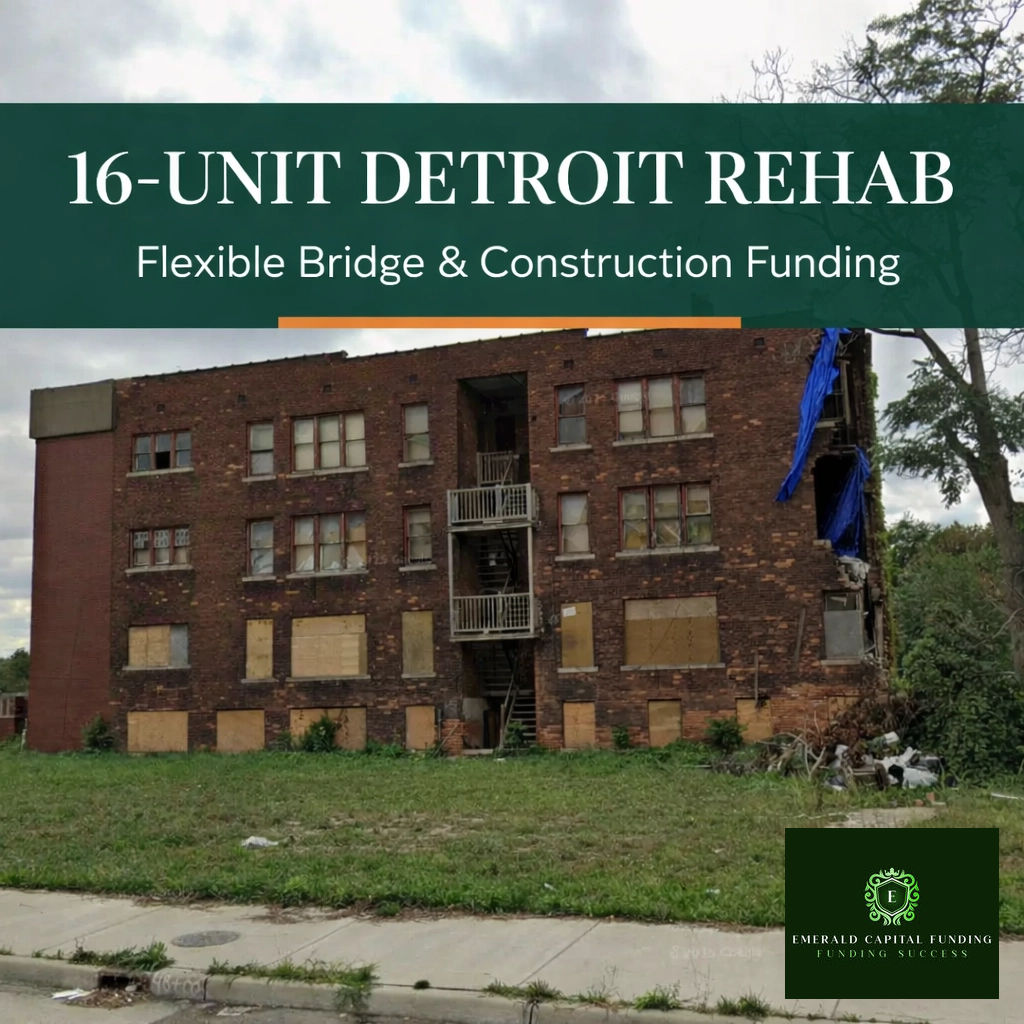

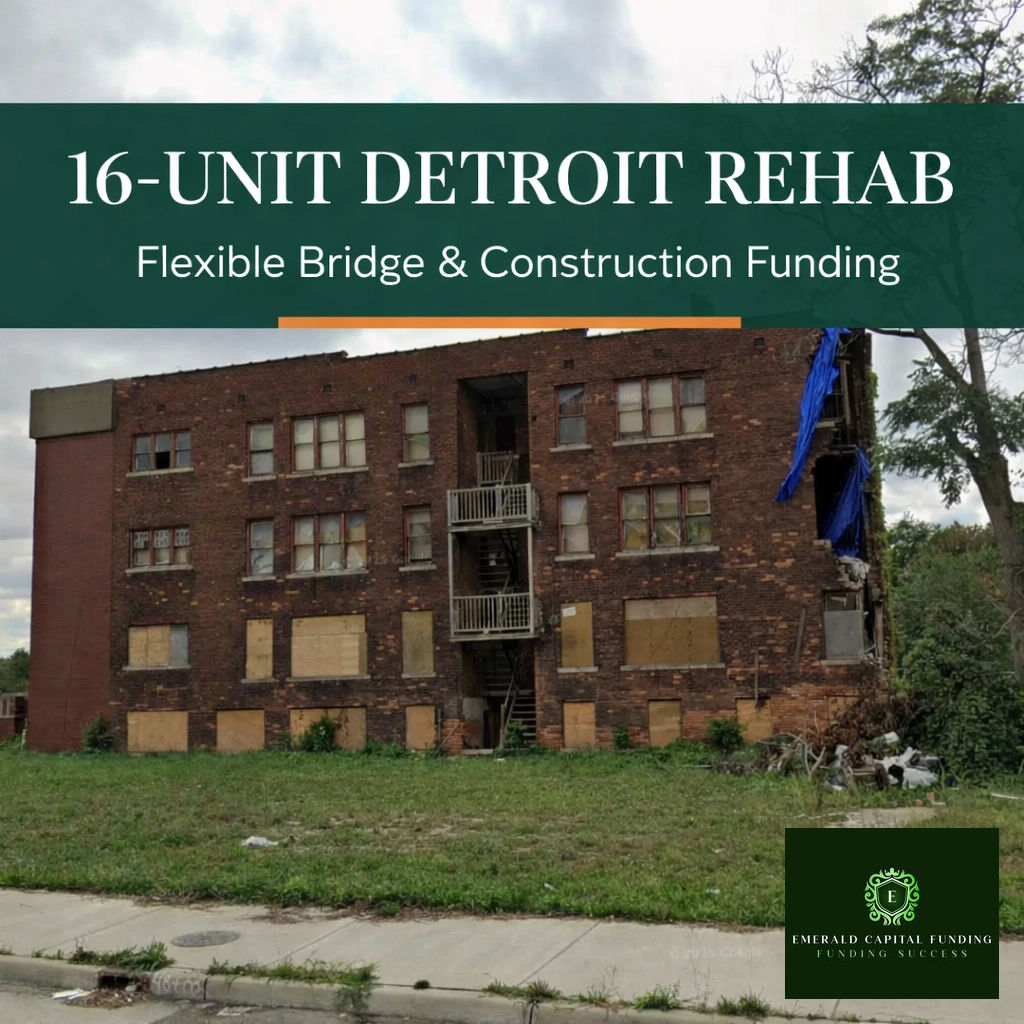

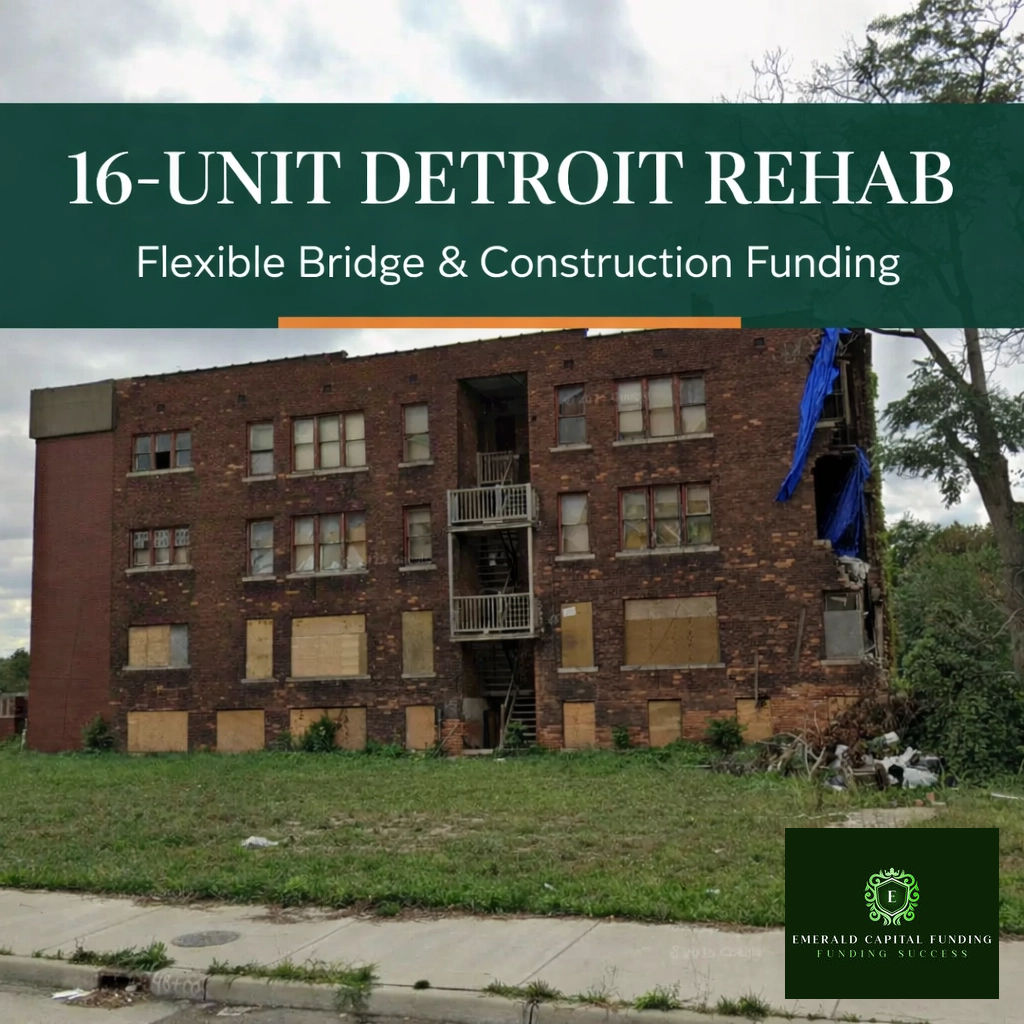

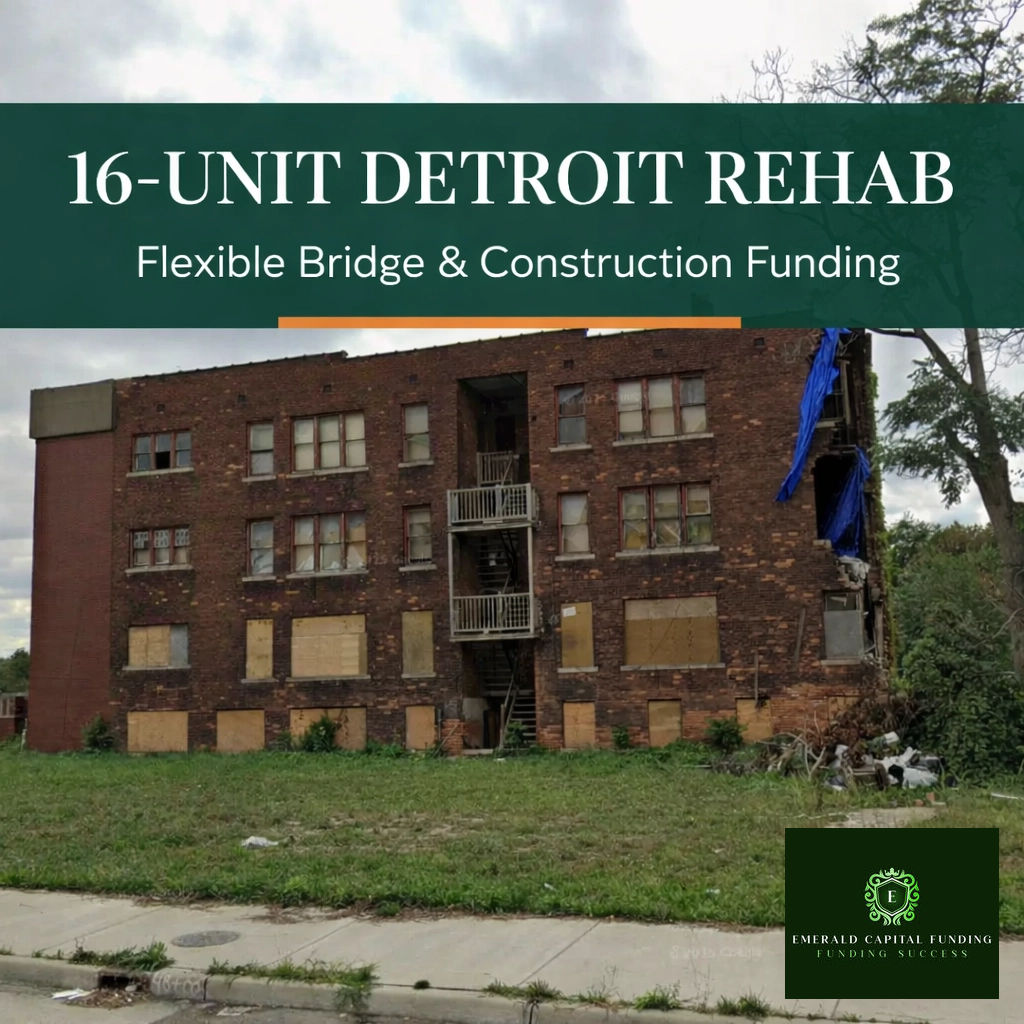

At Emerald Capital Funding, we aren't bound by those same rigid constraints. We look at the "Big Picture." If you’re scaling big in places like Detroit or Buffalo, you need a lender who speaks the language of investment, not just the language of "compliance."

Financing Options for Your Mixed-Use Project

If you’re looking to replicate the success of the Buffalo deal, you need to know which tools are in your belt. Here’s a quick breakdown of what we offer:

- Mixed-Use DSCR Loans: Best for properties where the residential component is significant. These typically offer 30-year fixed rates or hybrid ARMs (Adjustable Rate Mortgages).

- Bridge Loans: Perfect for "rehab-to-rent" scenarios. If the storefronts need a facelift before they can be leased at market rates, a bridge loan provides the capital to get the work done quickly. Learn more about Bridge Loan basics here.

- Commercial Real Estate Financing: For larger projects (like the 8-storefront monster), we can go up to 75% LTV (Loan to Value), providing the leverage you need to keep your cash for the next deal.

Actionable Takeaway: Before applying, make sure you have a clear "rent roll" for all units. Documentation is the key to a fast "Yes."

Frequently Asked Questions (Q&A)

Q: Can I get a loan if the property is more than 50% commercial?

A: Yes, but it will likely fall under a commercial loan product rather than a residential DSCR product. We handle both, so we can pivot the loan structure based on the property’s specific footprint.

Q: What is the minimum credit score for a mixed-use deal?

A: Generally, we like to see a FICO score of 660 or higher. However, because we are asset-based lenders, we have more flexibility than your local credit union might.

Q: Do I need to show my personal income tax returns?

A: For our DSCR and asset-based programs, usually no! We are looking at the property’s income, not yours. This is a pathway to financial security for many self-employed investors who have a lot of write-offs.

Q: What’s the maximum number of units you can fund?

A: For our standard mixed-use DSCR products, we usually cap it at eight units. For anything larger (like a 20-unit building with retail), we move into our commercial lending division.

Your Pathway to Financial Security Through Mixed-Use

Success within your reach often starts with seeing the potential where others see problems. The Buffalo deal wasn't "easy," but it was profitable. By combining a restaurant, storefronts, and residential units, the investor created a powerhouse of cash flow that is protected against market fluctuations in any single sector.

With the right approach, you can turn these complex properties into the cornerstone of your portfolio. Whether you are looking for DSCR loans explained or you need a custom bridge solution for a "Frankenstein" property of your own, we have the expertise to get it across the finish line.

Before you dive into your next big move, make sure you have a team that understands the nuances of mixed-use lending. We’ve seen it all: from Buffalo to Detroit and beyond: and we’re ready to help you fund the dream.

Ready to see what your mixed-use project could look like?

Apply Now with Emerald Capital Funding and let’s get those storefronts working for you. You can also Contact Us to discuss the specifics of your unique property. We don't just fund buildings; we fund your growth.